akkada.ru

Community

Codecademy Certificate

Codecademy courses aren't accredited, which means its certificates are only proof that you have successfully completed the course. If you are looking for an. Learn DevOps: The Complete Kubernetes Course (Udemy); Mastering Ansible (Udemy); AWS Developer (A Cloud Guru); React (CodeCademy); Build Python Web Apps with. Codecademy's certificates are legit in the way that they hold some value for potential employers – they're not useless in the real world. But, they. Discover & share this Codecademy GIF with everyone you know. GIPHY is how you search, share, discover, and create GIFs. Skip straight to Codecademy Pro. For an extra $10 a month, you'll get access to their career paths, technical interview prep, professional certifications, and. Codecademy. Learn to code interactively, for free. 24 teacher reviews certifications and that students receive certificates. It is great for some. No, Codecademy's free courses don't provide certificates after you finish the program. To get a Codecademy certificate, you need to subscribe to their Pro plan. Learners from every nook and corner of the world can opt for the Codecademy free courses with certificate, get certified and get placed in better job. It is worth the knowledge you gain from it, as any other certification is. Codecademy may not count for much because it tends to be used to learn the basics of. Codecademy courses aren't accredited, which means its certificates are only proof that you have successfully completed the course. If you are looking for an. Learn DevOps: The Complete Kubernetes Course (Udemy); Mastering Ansible (Udemy); AWS Developer (A Cloud Guru); React (CodeCademy); Build Python Web Apps with. Codecademy's certificates are legit in the way that they hold some value for potential employers – they're not useless in the real world. But, they. Discover & share this Codecademy GIF with everyone you know. GIPHY is how you search, share, discover, and create GIFs. Skip straight to Codecademy Pro. For an extra $10 a month, you'll get access to their career paths, technical interview prep, professional certifications, and. Codecademy. Learn to code interactively, for free. 24 teacher reviews certifications and that students receive certificates. It is great for some. No, Codecademy's free courses don't provide certificates after you finish the program. To get a Codecademy certificate, you need to subscribe to their Pro plan. Learners from every nook and corner of the world can opt for the Codecademy free courses with certificate, get certified and get placed in better job. It is worth the knowledge you gain from it, as any other certification is. Codecademy may not count for much because it tends to be used to learn the basics of.

Certificate of Cloud Security · Knowledge (CCSK) Bootcamp · Skillsoft Security Innovation · Cyber Range CMD+CTRL · Bootcamp · CLOUD SERVICES · CLOUD BASICS. Certificate of Cloud Security · Knowledge (CCSK) Bootcamp · Skillsoft Security Innovation · Cyber Range CMD+CTRL · Bootcamp · CLOUD SERVICES · CLOUD BASICS. If we compare Coursera vs CodeCademy, it's evident that Coursera has higher value for money than CodeCademy. Also I got a certificate after finishing! Read. From quick, practical courses to comprehensive certifications, learn everything you need to know about the most sought-after business skills. I completed another Codecademy course! This CSS journey made me think critically about the relationship between HTML and CSS. Course features · Modules inside Codecademy's Learn Python 3 · Module practice · Cheat Sheets · Projects · Quizzes · Code Challenges · Certificate of completion . Codecademy from Skillsoft is a comprehensive solution to developing new tech skills. Thousands of courses, instructor-led sessions, and a curriculum. Codecademy Courses. Codecademy is an online interactive platform that offers Harvard's CS50 Free Certificate Guide · How Open University Works · Free. I'm happy to share that I've obtained a new certification: Learn HTML Course from Codecademy! #html #generationusa #codecademy #certificate. If you're looking for a project-based learning experience, Codecademy might not be the best fit. Certificate Value: Codecademy's certificates are a nice way. Codecademy does not provide a certificate? we use every day. They work in Python, Git, & ML. Includes 7 Courses. With Certificate. Intermediate. 50 hours · Explore full catalog →. Free. New to coding. nope, not possible here on codecademy. but maybe here: akkada.ru you can get a certificate. this might be a bit higher level. List of Codecademy FREE courses with % off coupon code. Use these Codecademy free coupon and get Codecademy free courses with % off coupons. Types of Codecademy courses · Build a Website with HTML, CSS, and GitHub Pages · Analyze Data with R · Pass the Technical Interview with Python · Analyze. Codecademy doesn't give certificates but if you use google you can find sites who do. akkada.ru for example (bit expensive). Continue Learning · logo. MIT Professional Education. Professional Certificate Program in Real Estate Finance & Development. Featured · logo. Codecademy. Build. 9/16/ Michele Brown successfully completed the. Learn Intermediate JavaScript Course. Founder & CEO. OF COMPLETION. CERTIFICATE. Scan to verify. Codecademy Online Courses & Certifications. Showing 18 results. vendor. Learn How To code course. 1 review. Codecademy difficluty-level. 1 courses. Lean Python 3 Interactive Course. Coupon. 3 years ago. Lean Python 3 Interactive Course. Development > Programming Languages. Codecademy. 30hr.

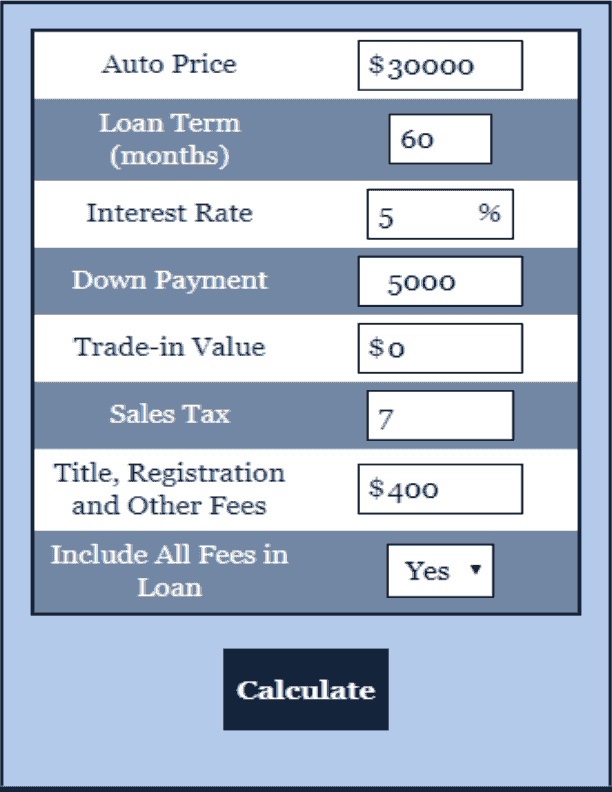

How Much Of My Car Payment Is Interest

For borrowers with credit scores of and above, the average interest rate for a new car loan has been %. The Bottom Line. Choosing a car loan is always a. The latest average APR rates for a new car is %, and for a used car are % if you have a Nonprime credit rating. These can vary depending on the length. Free auto loan calculator to determine the monthly payment and total cost of an auto loan, while accounting for sales tax, fees, trade-in value, and more. Reduce my credit card interest · Pay my credit card bill · Manage expenses My Auto Affordability Tool provides you with an estimate of how much you may. How much are car payments with a % interest rate? % APR car payments on a $ vehicle are $ per month for 5 Years. PMT = loan payment; PV = present value (loan amount); i = period interest rate expressed as a decimal; n = number of payments. Use our free auto loan calculator to estimate your monthly car payment and what a car loan will really cost you (including interest). payment and have a higher interest rate than someone with a better credit score. How much of a car loan can I qualify for? Everyone's situation will be. Use Bank of America's auto loan calculator to determine your estimated monthly payments and your approximate rate for a new or used car loan. For borrowers with credit scores of and above, the average interest rate for a new car loan has been %. The Bottom Line. Choosing a car loan is always a. The latest average APR rates for a new car is %, and for a used car are % if you have a Nonprime credit rating. These can vary depending on the length. Free auto loan calculator to determine the monthly payment and total cost of an auto loan, while accounting for sales tax, fees, trade-in value, and more. Reduce my credit card interest · Pay my credit card bill · Manage expenses My Auto Affordability Tool provides you with an estimate of how much you may. How much are car payments with a % interest rate? % APR car payments on a $ vehicle are $ per month for 5 Years. PMT = loan payment; PV = present value (loan amount); i = period interest rate expressed as a decimal; n = number of payments. Use our free auto loan calculator to estimate your monthly car payment and what a car loan will really cost you (including interest). payment and have a higher interest rate than someone with a better credit score. How much of a car loan can I qualify for? Everyone's situation will be. Use Bank of America's auto loan calculator to determine your estimated monthly payments and your approximate rate for a new or used car loan.

For example, if you had an auto loan of $20, with a 8% interest rate over four years, your estimated monthly payment would be $ Over the period of the. How much will my vehicle payments be? · Finance Your Car with Fifth Third Bank. Obtain a car loan with Fifth Third before you shop. · Car Loans and Credit Scores. how much car you can buy with a given monthly payment. It also takes into Can I get a % interest rate on my auto loan? More often than not, the. Free and easy-to-use automated calculator which quickly estimates your monthly car loan payments & helps you figure out how expensive of a car you can. Our calculator can help you estimate your monthly auto loan payment, based on loan amount, interest rate and loan term. Understanding Car Loan Interest · Principal Amount x Interest Rate x Time (in years) = Total Interest · Divide the total interest by the number of months in your. So if I pay $ per month, my questions are: how long until the car is fully paid off, because x 36 = $37, but i don't know how to. Your auto loan interest rate will have a big impact on your monthly car payment. The interest rate is how a car loan company makes money – think of it as a. At Mercedes-Benz Burlington, we understand that many of our neighbours with less-than-ideal credit scores have good reasons for their financial records. We can. How to Calculate Auto Loan Interest for the Coming Months · Subtract the interest from your current debt. The amount left is what you owe towards your loan. A car payoff calculator shows you how early you could pay off your auto loan with extra monthly payments and how much interest you could save over time. In Q1 , the average interest rate for a new car was % and % for a used car, according to Experian. When it comes to auto loans, most lenders use. The average auto loan interest rates across all credit profiles range from % to % for new cars and % to % for used cars. How to Calculate Auto Loan Interest: First Payment Only · Divide your interest rate by the number of monthly payments per year. · Multiply the monthly payment by. Use Carvana's auto loan calculator to estimate your monthly payments. See how interest rate, down payment & loan term will impact your monthly payments. Purchase Price: It is recommended that the monthly auto loan payment alone is limited to about 10% to 15% of your after-tax take-home pay. A lower purchase. That's because interest rate hikes announced by the Bank of Canada are applicable nationwide, generally keeping pace with inflation. Will my Auto Loan. Auto loan interest is the extra cost in addition to your loan principal — your starting loan amount — that lenders charge you for borrowing money. Your interest. First payment date ; Original loan amount · $0. $k. $1m. $10m ; Interest rate · 0%. 8%. 16%. 24% ; Original loan term · 84 ; Monthly Prepayment amount . Sell My Car · Instant Cash Offer; Car Research & Tools Car Research & Tools Comparing interest rates can pay off big time when buying a used car since.

How Do I Report Virtual Currency On My Tax Return

The IRS requires American crypto investors to report their cryptocurrency transactions, including gains, losses, and income, by April With the IRS tracking. With respect to IRS reporting, cryptocurrency is reported on the as a non-cash gift, and on Form , Schedule M if applicable. Donee organizations must. If you dispose of cryptocurrency during the tax year, you'll need to fill out IRS Form The form is used to report the sales and disposals of capital. The question, revised to update terminology by replacing “virtual currencies” with “digital assets,” appears at the top of Forms , U.S. Individual Income. If you have bought, sold, mined or have virtual currency assets such as Bitcoin, you must report this in your tax return. Get help to determine the value. Tax. First, many cryptocurrency exchanges report transactions that are made on their platforms directly to the IRS. If you use an exchange that provides you with a. Regardless of whether you had a gain or loss, these transactions need to be reported on your tax return on Form When you receive cryptocurrency from. Reporting Cryptocurrency Transactions to the IRS: A Step-by-Step Guide. Any cryptocurrency gain, loss, disposition, or income-triggering event must be reported. Tax form for cryptocurrency · Form You may need to complete Form to report any capital gains or losses. Be sure to use information from the Form The IRS requires American crypto investors to report their cryptocurrency transactions, including gains, losses, and income, by April With the IRS tracking. With respect to IRS reporting, cryptocurrency is reported on the as a non-cash gift, and on Form , Schedule M if applicable. Donee organizations must. If you dispose of cryptocurrency during the tax year, you'll need to fill out IRS Form The form is used to report the sales and disposals of capital. The question, revised to update terminology by replacing “virtual currencies” with “digital assets,” appears at the top of Forms , U.S. Individual Income. If you have bought, sold, mined or have virtual currency assets such as Bitcoin, you must report this in your tax return. Get help to determine the value. Tax. First, many cryptocurrency exchanges report transactions that are made on their platforms directly to the IRS. If you use an exchange that provides you with a. Regardless of whether you had a gain or loss, these transactions need to be reported on your tax return on Form When you receive cryptocurrency from. Reporting Cryptocurrency Transactions to the IRS: A Step-by-Step Guide. Any cryptocurrency gain, loss, disposition, or income-triggering event must be reported. Tax form for cryptocurrency · Form You may need to complete Form to report any capital gains or losses. Be sure to use information from the Form

Note: The IRS is cracking down on virtual currency reporting requirements. As a practitioner, make sure you're asking clients about any virtual currency. One way to make it easier to report income is to receive the payment in crypto and then exchange the cryptocurrency into dollars. You can then report your. The IRS uses the term “virtual currency” to describe the various types of convertible virtual currency that are used as a medium of exchange, such as digital. Crypto Currency Taxes refers to the process of reporting income or gains from cryptocurrency trading on a Federal level. The IRS considers cryptocurrency to be property, and capital gains and losses need to be reported on Schedule D and Form if necessary. Virtual currency transactions in the United States are taxable by law, just as transactions in other property. Under IRS rules for virtual currency, gains and. Generate tax Form on a crypto service and then prepare and e-file your taxes on FreeTaxUSA. Premium federal taxes are always free. Once you answer 'Yes' on the cryptocurrency tax question on Form , you should report all of your taxable cryptocurrency transactions on your tax return. The IRS treats virtual currency as property for federal tax purposes. This means that, depending on your circumstances, Bitcoin can be classified as business. Did you know that individuals earning more than $ in staking or rewards are required by the IRS to report the earnings and send in Form MISC? Complete a Schedule C to report the earnings. The IRS does not allow Like-Kind exchanges for virtual currency transactions. Additional Information. The IRS has not released significant guidance on virtual currency transactions in over five years. In March , the IRS issued Notice (the Notice). Apps like Coinbase, Robinhood, and PayPal are required to report transactions to the IRS. Do I Owe Tax if I Exchange One Virtual Currency for Another? Yes. In. Under current law, the cryptocurrency owner is responsible for reporting all transactions to the IRS. "You're not going to get a Form from the currency. If you use virtual currency to pay an employee's wages or an independent contractor's fee, it will be subject to the same tax and reporting as any other payment. Starting September 1, , the Colorado Department of Revenue (DOR) will now accept Cryptocurrency as an additional form of payment for all state taxpayers. However, in the cryptocurrency world, it's all about trading and selling, and this is where your purchase becomes taxable in the eyes of the IRS. So whether you. If you earned more than $ in crypto, we're required to report your transactions to the IRS as “miscellaneous income,” using Form MISC — and so are you. The value of cryptocurrency received as salary is reported as income on the W-2 form. Any subsequent gains or losses are subject to capital gains tax. Receiving.